One drug with many uses – the win-win proposition for patients and pharma. The concept of applying a single mechanism of action to treat a range of different patient populations and needs has largely defined the pharmaceutical industry’s approach to drug development for the past two decades. Success stories of indication expansion strategies creating enormous brand value can be found across nearly all therapy areas. From inflammation (e.g., Humira) and oncology (e.g., Keytruda), to neurology (e.g., Lyrica) and ophthalmology (e.g., Eylea), the catalogue of drugs with an ever-expanding list of on-label indications is vast. From a commercial perspective, it may be easy to agree that a broad market is more appealing than a niche market. But the process of designing a lifecycle management plan to enable realisation of the full potential of a broad mechanism – this is far from simple.

Lifecycle management strategy simultaneously addresses two important questions for an asset: “What now?” and “What next?”. In the context of a developmental product with multiple potential disease applications, it could be argued that selection of the lead indication is equally as important as the selection of the second, third, and fourth – a strategic indication sequence can help to ensure the asset remains competitive through all phases of its lifecycle and that its trajectory of new approvals delivers a compelling value proposition to physicians, patients, and payers alike.

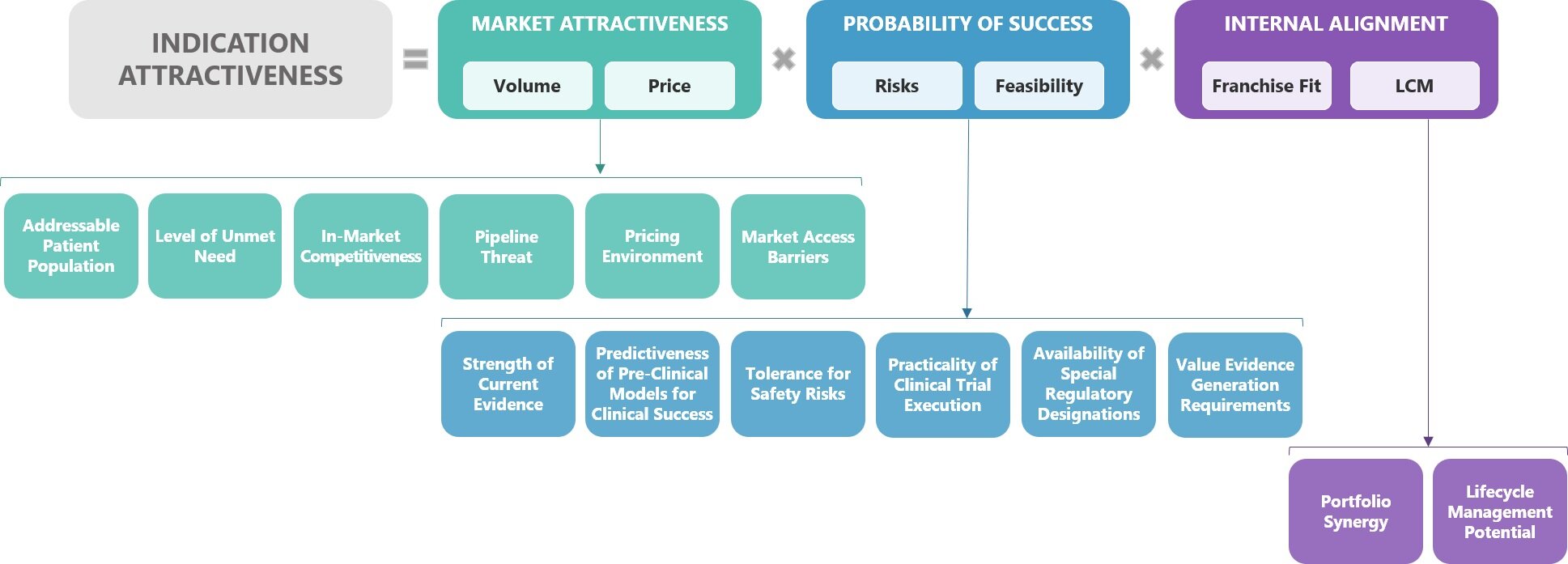

Prioritising and sequencing possible indications for an asset requires thorough evaluation of a myriad of factors that influence the attractiveness of each indication within the bounds of a manufacturer’s strategic goals. Balancing of this set of factors, though a highly complex process, is a critical step that is necessary to reduce uncertainty and drive informed decision-making for a drug discovery portfolio. So, when faced with the challenge of evaluating a list of possible pathways for your developmental product:

How would you approach this process?

What questions would you investigate?

Which answers would you regard as being most important?

Consider the following scenario: If two potential future patient populations have been explored, both with significant unmet need, but “Indication A” has a larger target patient population, less competitive saturation, and strong alignment to the existing portfolio, while “Indication B” offers a more manageable evidence generation requirement and a strong pathway to patient access with payers, which one should be prioritised for development if resources are not available to target both options? This is a loaded question and one that will have many valid answers. But attempting to derive the answer without all of the relevant considerations at hand leaves room for blind spots and uncertainty; and blind spots and uncertainty leave room for frail strategic plans, encroaching competition, and misguided corporate expectations.

Although indication prioritisation may present as a Pandora’s box of interlinking considerations, a strategic and structured approach will not only ease the burden of these complex decisions but will also ensure that the considerations on the table are exhaustive. A comprehensive indication assessment framework, such as the one outlined below, can serve as a useful tool to guide research and cross-functional decision-making.

This indication assessment framework consists of three overarching considerations, each of which aims to answer questions fundamental to strategic indication prioritisation decision-making:

Market attractiveness: What is the potential value this asset could deliver to patients, healthcare systems and the company?

Probability of success: What are the potential barriers to development? Where should I anticipate risks and to what extent do these risks impact feasibility?

Internal alignment: Will development in this indication align with or complement our current and future portfolio and company strengths?

Developing a repository of insights aligned to a strategic framework of considerations is a critical step, but it does not mark the completion of the journey to informed indication selection and LCM decision-making. Although many factors influencing indication attractiveness exist, not all will have equal impact. And while the indication assessment framework is designed to be applicable to any product and all organisations, the relative importance of each consideration comprises a unique fingerprint that reflects the specific circumstances surrounding a particular asset.

As a result, translation of the indication attractiveness framework’s insights into actionable recommendations first requires weighing the relative importance of each consideration in order to reflect the specific objectives for your asset and your company. In order to determine the relative importance of each factor, the meaning of success within the context of the launch for your asset should be clearly defined.

Articulating the core objective as it relates to the asset in focus can help to point out which factors within the indication assessment framework are most important for your decision-making process. And importantly, the core objective cannot be designed in a silo; gaining cross-functional alignment on the long-term strategic vision for an asset is yet another essential step. But to effectively bridge multi-disciplinary perspectives and agree on a common goal, it is critical to have all influential factors laid on the table for consideration.

Designing the optimal indication launch sequence for your asset requires an up-to-date understanding of the factors at play so you can be informed; a clearly defined objective so you can be guided; and cross-functional buy-in so you can be aligned. Which of these are still on your to-do list?

Join us as we continue our series on key considerations related to indication prioritization; in our next piece, we take a look at a two-step approach to defining an asset’s addressable patient population, empowering teams to maximize all viable opportunities.