Is there too much simplicity in the standard approach to evaluation of unmet need?

Unmet need is an ever-present reality in the medical world and an important influencer of market attractiveness. Unmet need can be relatively easy to identify through the traditional methods – wherever patients (and/or other disease stakeholders) are reporting to be negatively impacted by their disease or the therapies they use to treat that disease, there is unmet need waiting to be addressed. In the context of an indication prioritisation exercise, unmet need is an essential field to capture and build on. However, this consideration can be very easy to oversimplify, risking oversight of true opportunity for a developmental asset. As every pharmaceutical manufacturer’s end goal is to provide innovative solutions that meaningfully address patient needs, is there a requirement for a more rigorous process of evaluating unmet need at the early stages of indication evaluation?

We challenge individuals contributing to indication assessments to look beyond a simplistic view of unmet need by considering three critical questions discussed below.

What Dimensions of Unmet Need Exist and What is the Intensity of Each?

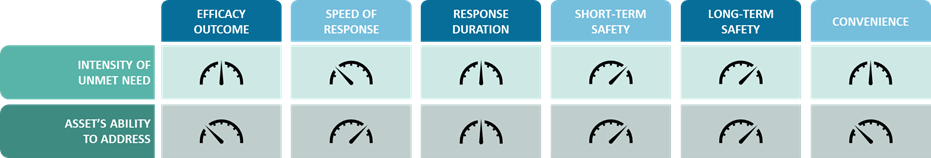

Too often, unmet need is reduced to a discussion focused on efficacy of current treatments. While efficacy outcomes are undoubtedly one of the most important aspects of unmet need, it is far from being the only one. Unmet need is multi-dimensional; therefore, a robust assessment of unmet need should be approached in this very way. By beginning with a framework designed to outline the dimensions of possible unmet need, this will enable exhaustive defining of exactly which unmet needs exist in a given indication. Is there need related to improvement in efficacy? Speed of response? Short- or long-term safety? Convenience of administration? These dimensions do not necessarily have to represent equal “weight” in the analytical framework – e.g., for a terminal condition, unmet need related to efficacy will be considerably more important than convenience-related unmet needs. However, ideally all dimensions should at least be considered to ensure no potential opportunities are left on the table.

To further enrich the analysis, consider expanding beyond a binary scoring system. Adding granularity by characterising the specific intensity of each dimension of unmet need will bring precision to the analysis, shining the spotlight on the most critical unmet needs to address without losing sight of those that are perhaps relatively less critical, but still exist.

Can the Asset Conceptually Address the Unmet Need?

When an unmet need is identified to exist, the disease begins to take shape as a promising opportunity for those seeking to bring transformative solutions to patients, particularly if the intensity of that unmet need is high. However, the level of value that a confirmed unmet need adds in terms of indication attractiveness is not automatically high. In fact, a high-intensity unmet need offers little to enhance overall market attractiveness if the asset in focus could not conceptually address the particular dimension of identified unmet need. For unmet need to act as a positive driver of opportunity, the existing need and the therapeutic offering’s benefit must link together. We therefore recommend using a two-pronged scoring system that simultaneously measures the intensity of each dimension of unmet need alongside the asset’s ability to address that particular dimension of unmet need.

By building in this consideration at the early stages of indication evaluation, the discussion on unmet need gains important context and confirms not only that at least one dimension of unmet need exists, but that the asset would provide a meaningful solution in response to that need.

Will the Unmet Need Still Exist at Launch?

When a disease’s intensity of unmet need has been characterised as being high and it is determined that the asset could conceptually address at least one dimension of need, this may increase the overall attractiveness of opportunity available in that disease. However, a further reality check should also be applied: How will the intensity of the identified unmet need change in the time before the asset’s launch? It goes without saying that unmet need is a moving target. Thanks to a rich pipeline of innovative therapies, the most critical therapeutic needs in a given disease from 5-10 years ago may no longer exist today. When investigating the status of unmet need among a set of indications of interest, it is essential to assess this through the lens of the future treatment landscape for that indication. Will the unmet need uncovered in the disease likely be addressed by a competitor by the time the asset launches? This consideration is particularly pertinent if the launch of the asset would be many years away. Of course, without a crystal ball, we cannot be certain about what the future treatment landscape holds, but efforts to understand emerging trends will undoubtedly pay off by providing even deeper context to support discussions on unmet need as a market attractiveness factor.

Concluding Thoughts

When building in unmet need as a driver of indication attractiveness, attempting to quantify the “overall” level of a disease’s unmet need and relying on this input alone oversimplifies this important consideration for cross-indication comparison. In order for the unmet need to be a true opportunity driver, elevate the rigour of your analysis by keeping the following in mind:

- Do not limit assessment of unmet need to the effectiveness of current treatments; ensure you are evaluating multiple dimensions of unmet need and measuring the intensity of each individually

- Do not assume that because unmet need exists in a disease, it should be a prioritised opportunity for your asset; ensure your asset has the conceptual ability to address at least one of the identified unmet need dimensions

- Do not ignore evolving trends in the disease landscape; ensure that the unmet need is likely to still be present at the time of your asset’s launch

In our next article, we will discuss another critical consideration for indication prioritisation – competition in the current and future disease landscape. Stay tuned for our viewpoints on assessing the intensity of competition, predicting the potential shifts it may drive in disease management, and understanding the relevant implications for new market entrants.